When most of us think about 9/11, the terrible impact it made on the victims and their families is the first thing that comes to mind. But there’s another aspect of these events that also needs to be remembered: the devastating effects they had on investors and the U.S. economy.

The most immediate of these consequences was on Wall Street. From the moment it became clear that America was under attack, stock prices began to plunge and chaos ensued in the markets.

Both the New York Stock Exchange and NASDAQ came to the conclusion that they had to move quickly to prevent complete turmoil, and officials at the NYSE and NASDAQ decided to close both markets until September 17 – the longest such “holiday” since 1933.

There was also another reason for their decision. Many brokerages, stock trading, and bond firms were destroyed when the towers collapsed, and Wall Street needed time to sort out the damage and figure out how to proceed.

Unprecedented Decline

On Sept. 10, 2001, the Dow Jones Industrial Average closed at 9606. When trading resumed on September 17, all the worry about a big selloff proved to be justified. The Dow fell to an intra-day low of 8755, and at the closing bell it had dropped 684 points, at the time the biggest single-day point decline ever.

The selloff continued. By the end of the week, the Dow had dropped approximately 1370 points, a decline of 14%. In the five trading days from Monday, Sept. 17, through Friday, Sept. 21, stocks lost a staggering $1.4 trillion of their value.

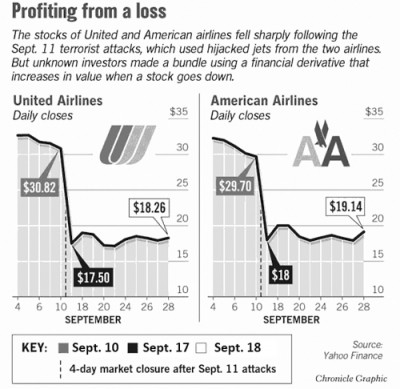

While the losses were devastating for the market as a whole, the pain was even worse for certain industries and particular stocks within them. Both American Airlines and United Airlines, the carriers whose planes were hijacked and used to carry out the terror attacks, were hit especially hard. Shares in American fell 39% that week, while United fared even worse, falling 42%.

Other stocks in the travel and entertainment industries also sold off sharply. So did some financial firms; Merrill Lynch and Morgan Stanley dropped 11.5% and 13% respectively.

And some insurance firms also took it on the chin. One of the biggest losers was Berkshire Hathaway, the Warren Buffett-controlled company. It eventually paid out $40.2 billion to settle 9/11-related claims, and because of those losses, Berkshire and most other insurance companies subsequently stopped offering policies to protect against losses caused by terrorism.

What’s Going On?

What made matters worse was that no one fully understood what was happening and no one was able to predict the impact the terror attacks would have on the economy and corporate profits. Uncertainty and fear were further heightened on Wall Street and Main Street as rumors of additional attacks persisted, and they pushed an already weakening economy even closer to recession.

President Bush spoke to the nation and told the American people to expect a war against terror that could last for many years. Savvy investors who listened closely to his address found new opportunities to make money in the market.

Many security and defense firms fared well in this environment, as the demand for their products and services increased; some of these companies also developed exotic new products, which were quickly scooped up by both commercial firms and governments. One such company was Magal Security Systems, a small Israeli company that was listed on the NASDAQ. Its shares were trading at about 8 when the attacks occurred, and by April 2004 they had increased to 20.

But some speculators in options made really big profits. Options are very risky and usually result in losses for those who try to time the stocks of particular companies or the markets.

Speculators bought call options on defense, security, and related industries, while others bought put options on airlines, entertainment, insurance, and some financial firms. It’s interesting to note that the number of options that traded just before the 9/11 attacks and immediately afterward was way above normal. In any case, in the short term, some option bulls and bears made significant profits.

As a group, the investors who had the courage to buy stock when others were panicking and anxious to sell at any price also enjoyed very significant gains over the long term. The Rudyard Kipling poem If comes to mind: If you can keep your head when all about you are losing theirs... you are a man, my son.

Knee-Jerk Reactions

Unfortunately, terrorist attacks have become part of our lives and atrocities committed after 9/11 also had economic consequences. There have been numerous attacks in the EU since then and those markets also responded to attacks by posting sharp losses.

For example, following the Nov. 2015 terrorist attacks in Paris, the French market opened with a loss of more than 1%, and other markets in the EU also declined. Investopedia cites one estimate that the attacks in Paris resulted in losses of more than $2 billion in stocks in the EU’s travel and leisure industries. However, bargain hunters stepped in and prices recovered quickly. The patterns of the markets following terrorist attacks in London and Brussels were very similar.

Felt Around The World

American investors are very concerned when there are terrorist attacks abroad, for a variety of reasons: they may have investments in those countries, may be considering making investments there, or are trying to gauge how U.S. markets will be affected. Revenues and profits of businesses based in countries that suffer terrorist attacks sometimes decline sharply.

Unfortunately, terrorism has become an ongoing problem for the world. These days, the terrorist group ISIS often threatens to attack the U.S. and other countries. And the U.S. State Department sometimes finds it necessary to warn U.S. citizens not to travel to certain countries because of safety concerns, and advises them to leave if they are already there. Of course, economic ramifications pale when compared to the threat to human life and safety – but they are a consideration.

Obviously, no one can predict when or where a terrorist attack will occur. We are living in dangerous times and terrorism remains a real threat to people around the world, despite all the security measures and precautions that have been taken. Even people who are not physically injured from an attack could suffer from trauma and sometimes from financial losses steep enough to change their lives.

No one takes safety for granted anymore. As we draw closer to Rosh HaShanah, we pray not only for our own safety but for that of other people and the world as well. May the upcoming year bring good health to all. And may Hashem Yishmor.

Sources: businessinsider.com; investopedia.com;yahoofinance.com.

The Forgotten Effects Of The 9/11 Attacks

Typography

- Smaller Small Medium Big Bigger

- Default Helvetica Segoe Georgia Times

- Reading Mode